If you need money urgently but don’t know where to borrow it. we introduce to you the Opay Merchant Loan. This article will guide you on the Best Way to Apply for Opay Merchant Loan and receive the loan in minutes.

The Best Way to Apply for Opay Merchant Loan in Nigeria

It is very exciting to know that OPay now offers merchant loans for more active users with a 3% short-term interest rate and up to a 15% long-term interest rate, with lower interest charges, making the new feature simple and straightforward.

Before going into the main discussion, I will love to explain what Opay is all about, its major functions, its services, what it is known for, and how you can successfully apply for an Opay Merchant Loan.

And after that, answers to the questions listed below will be provided in this article, so you don’t have to worry yourself; just sit back and read this article to the end.

- How to Be Eligible for Opay Loan?

- How can I borrow 50k from Opay?

- How do I qualify for an Opay loan?

- What is the limit of merchant account in opay?

- What is merchant loan on Opay?

- How do I claim 1200 on OPay?

- Which code can I use to borrow money from Opay?

- Which loan app works with Opay?

- How much can I borrow from OPay for the first time?

- Can OPay send money internationally?

Just to mention a few, let’s now validate what Opay is all about.

What is Opay

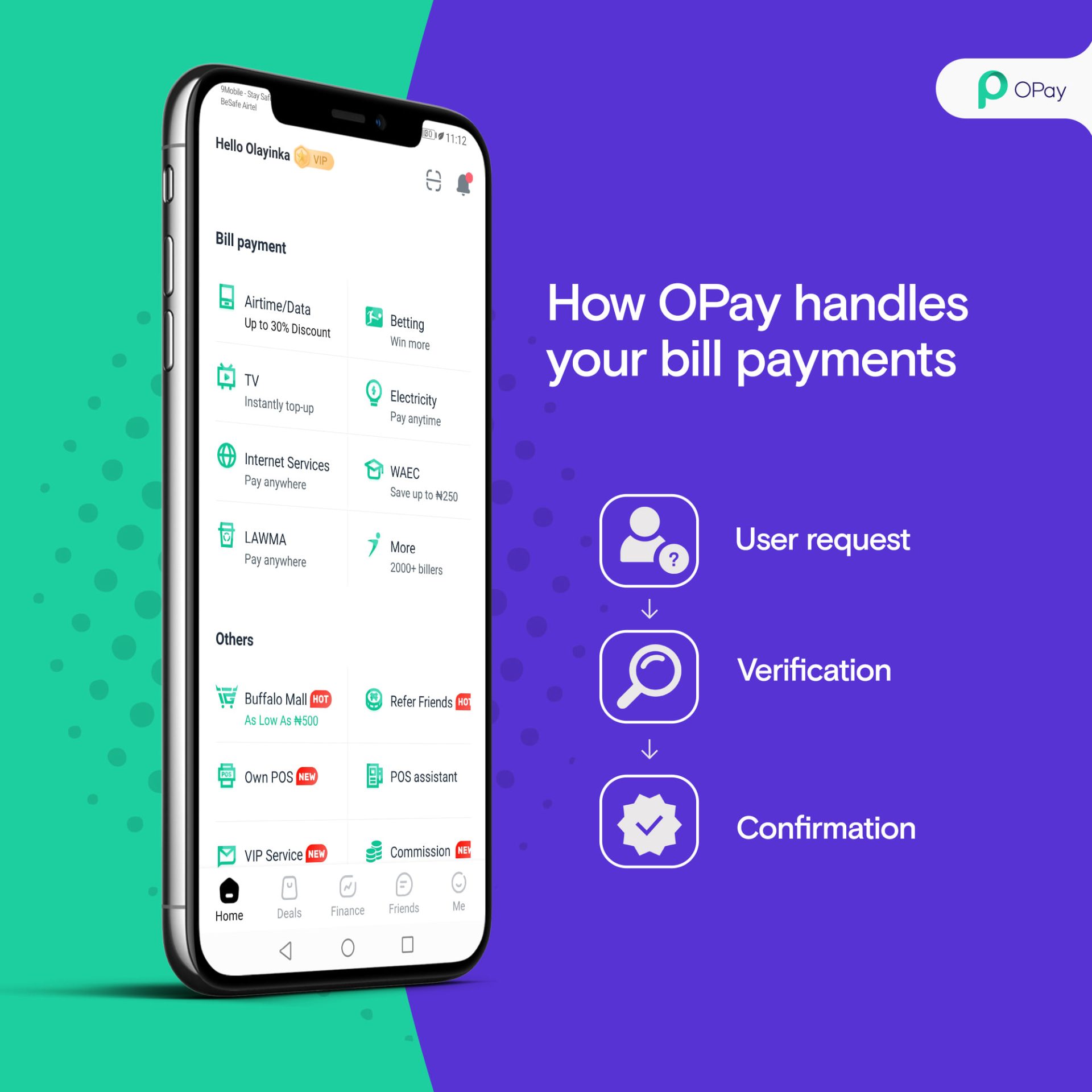

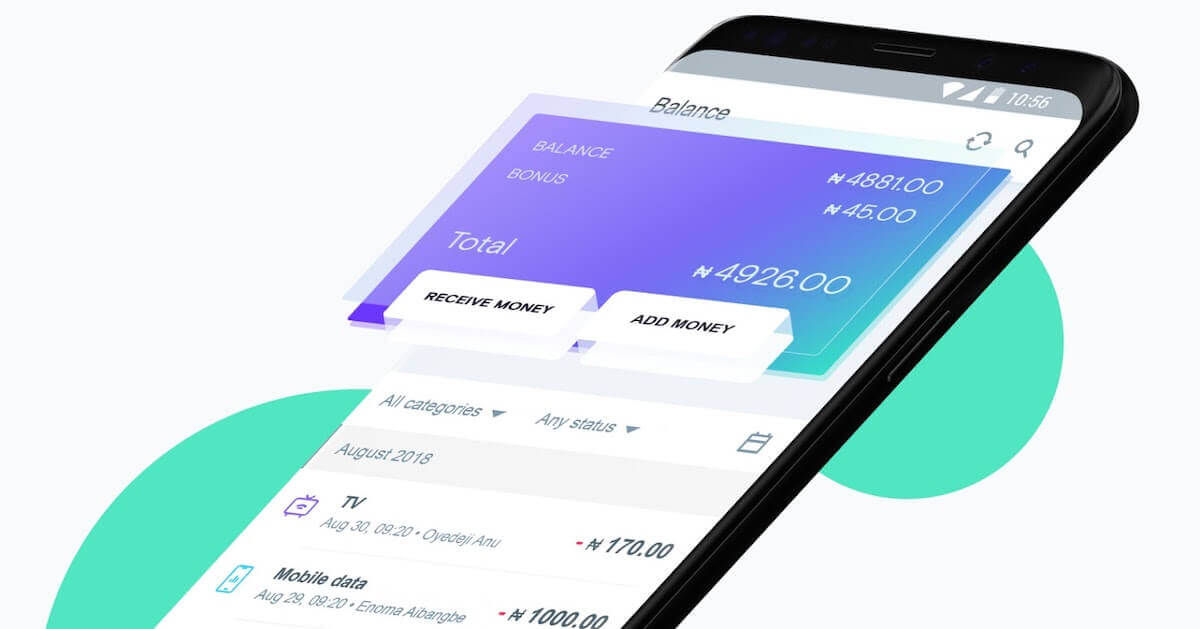

First of all, the word Opay is the abbreviation of Opera Pay, and it is an online payment platform that offers various transactions such as buying airtime, data, electric bill payments, Pay TV subscriptions, rider hailing, food delivery, QR payment, investment, OKash loan (Opay Merchant Loan), betting account funding, product listing, and online presence building through OList and OLeads, and a lot more.

Furthermore, Opay, as we all know, is a unique finance app with unique features, including the ability to borrow money. This online payment platform was launched in 2018 by Opera Norway AS Group. The site is one of the best online borrowing apps in Nigeria that allows its users to borrow money.

Opay has over 35 million registered app customers and about 500,000 agents across the country. Opay also renders a wide scale of financial services, including:

- Mobile money transfers

- Bill payments

- Airtime and data top-up

- Merchant payments

- Online shopping

- Loans

- Savings

- Insurance

- Investments

As you can see, Opay is providing not just these services but also making them affordable and accessible to everyone, irrespective of their background or location. Below are some of the things Opay is known for.

- Its services are global.

- The app is reliable and easy-to-use for all users.

- It is affordable, you can even open an Opay account with a very small amount.

- They give back to the community by providing loans.

Here is vital information about OPay:

- The headquarters of Opay in Nigeria is in Lagos State.

- Opay has offices in Nigeria, Pakistan, Egypt, and Mexico.

- The company (Opay) is sponsored by some top venture capital investors, including SoftBank Visit Fund, Tiger Global Management, and Sequoia Capital China.

- Opay is among the best online investment companies in Africa.

How to Be Eligible for Opay Loan?

- First, you must be a Nigerian.

- You must be between the ages of 18 and 55.

- You must possess a legal and valid means of identification, such as an NIN, an international passport, etc.

- You must be the owner of a smartphone with good network connectivity.

- You must have an active bank account.

- You must be a monthly income earner

- You must not be involved in any money laundry

Check Also

How can I borrow 50k from Opay Using USSD?

Below are simple steps on how to use the Opay USSD code to get a loan

- On your mobile phone, dial *955# (note that only the Opay account registered number can be used).

- Select the “Loan” option.

- Pick the loan for which you are eligible and apply.

- Provide all the required information.

- Once you are done, you will receive your loan in your account.

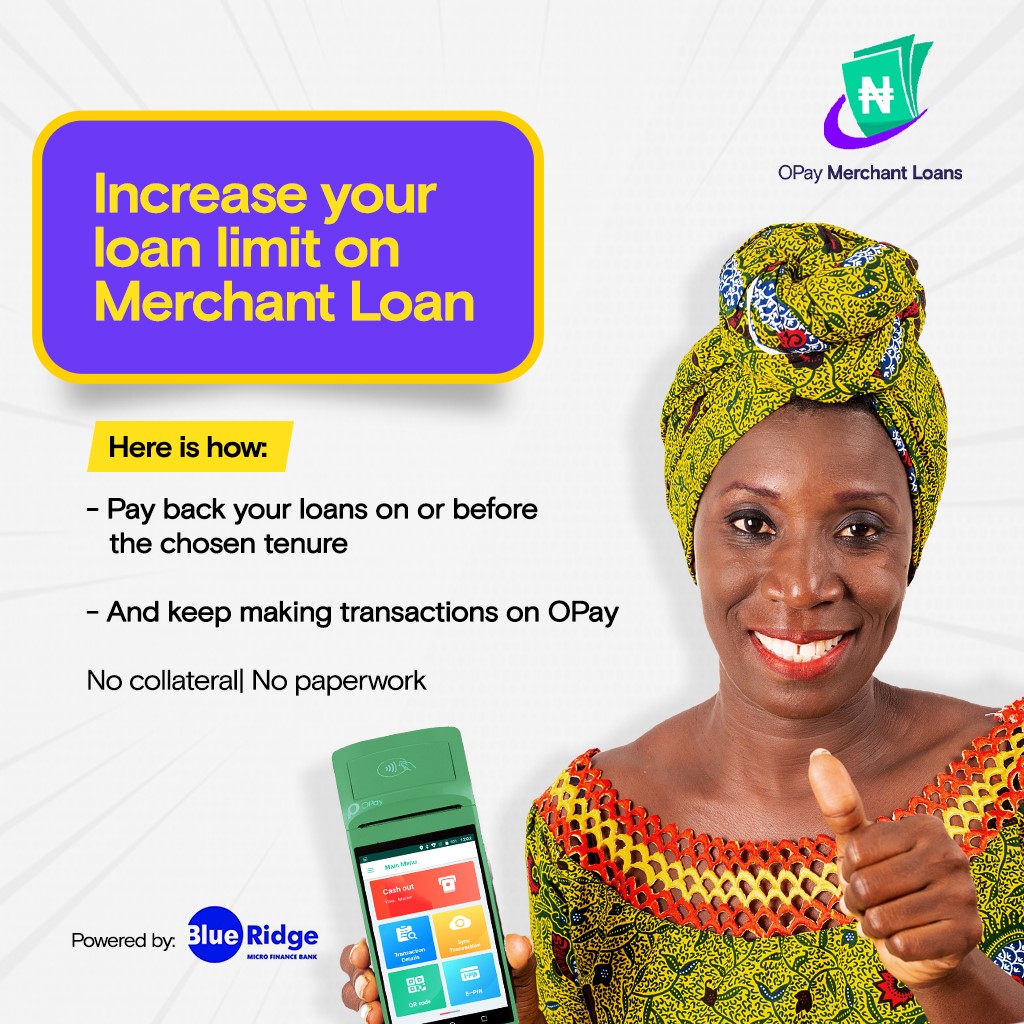

What is Merchant loan on Opay?

Opay Merchant Loan grants vendors access to quick loans on the Oapy app for up to 5 million naira.

Which code can I use to borrow money from Opay?

To get either a loan or borrow money from Opay, kindly use *955#; this is the Opay USSD code. You can use this code by dialing it on your mobile phone and following the instructions to get the loan.

How much can I borrow from OPay for the first time?

This is an important question. The minimum amount you can get or request from Opay (Okash) as a first-time user is 30,000 Naira, while the maximum amount is 50,000 Naira. You can only request a higher amount when you repay the initial loan.

The Best Way to Apply for Opay Merchant Loan in Nigeria

Now, let’s look at the best way and steps how to apply for an Opay Merchant Loan in Nigeria.

- For those who don’t have an Opay account,

- Download the Opay Mobile App. (Follow the instructions to open an account.)

- After that, follow the steps below.

- Open the Opay User App

- If you don’t find Merchant Loan on your Opay homepage or dashboard, kindly update the app.

- Click on Merchant Loan (after updating the app).

- Carefully go through the loan rules and regulations.

- Agree to the terms and conditions of services.

- Highlight Merchant Loan Credit Limits

- Choose the loan type you wish to apply for.

- Follow carefully the process attached to complete the loan application form.

- Submit your loan application when done. A few minutes after your successful application, you will receive your loan amount.

- Most importantly, you can only see the Merchant Loan feature on the Opay app.

I hope this article is insightful and useful, and that you have been satisfied with the information provided on this page concerning how you can request a loan on the Opay app and also the Best Way to Apply for Opay Merchant Loan in Nigeria.

And also, if you would like to ask any questions or make more findings on this subject, let us know in the comment section below.

Ongoing Recruitments in Nigeria

- UBA Recruitment

- TAJ Bank Recruitment

- Jaiz Bank Recruitment

- Access Bank Recruitment

- Providus Bank Recruitment

- Union Bank Recruitment

- First Bank Recruitment

- Zenith Bank Recruitment

- World Bank Recruitment

- Moniepoint MFB Recruitment

- H-Medix Recruitment

- Parallex Bank Recruitment

- Sparkle Bank Recruitment

- FSDH Merchant Bank Recruitment

- Coronation Merchant Bank Recruitment

- Heritage Bank Recruitment

- SunTrust Bank Recruitment

- Fidelity Bank Graduate Trainee Program

- Unity Bank Graduate Trainee Programme,

- Access Bank Graduate Trainee Programme,

- Premium Trust Bank Graduate Trainee Salary

- KPMG Graduate Trainee Recruitment

Author Profile

- Smith Godwin has been a writer at Kindi Recruit for a long time. He has confidence in roles that require a high level of diligence, strong teamwork, and advanced problem-solving skills, along with dedication to achieving uncompromising quality of work under stringent deadlines in an organization.

Latest entries

RecruitmentMarch 4, 2024CBN Recruitment Exams and Past Questions and Answers (2010-2024)

RecruitmentMarch 4, 2024CBN Recruitment Exams and Past Questions and Answers (2010-2024) BlogFebruary 28, 2024Top 10 Highest Paying Tech Jobs in Nigeria 2024 Update

BlogFebruary 28, 2024Top 10 Highest Paying Tech Jobs in Nigeria 2024 Update Ask KindiFebruary 28, 20245 Best Careers in Nigeria for You ( 2024 Update)

Ask KindiFebruary 28, 20245 Best Careers in Nigeria for You ( 2024 Update) RecruitmentFebruary 27, 2024Ongoing Recruitment in Nigeria 2024/2025 | Recruitment News in Nigeria Today

RecruitmentFebruary 27, 2024Ongoing Recruitment in Nigeria 2024/2025 | Recruitment News in Nigeria Today